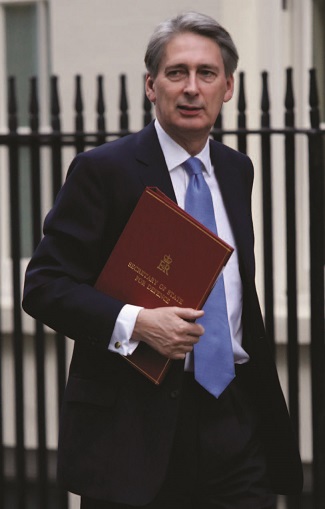

Braced for Budget

Philip Hammond, the Chancellor of the Exchequer, will deliver his next Budget speech on 22 November 2017. This will not be a half-hearted Autumn Statement, but a full-thrust Budget, with proposals designed to brace the economy for Brexit turbulence.

Hammond decided to move the main Budget event from the Spring to the Autumn to allow time for consultation on new tax measures before they are implemented from April 2018. This should avoid the retrospective imposition of tax changes, which tends to happen when draft tax law is released in March to apply from the next 1 or 6 April, but the Finance Act introducing that law is not passed until July.

This year the Parliamentary timetable was disturbed due to the snap General Election in June, but most of the postponed tax changes are coming into effect from the dates originally proposed. This includes new ‘deemed domiciled’ rules for long-term UK residents, new allowances to cover small amounts of income from letting property or trading, and the cash basis of accounting for residential property landlords (with the option to opt out and use normal accounting).

One tax innovation which has been amended over the summer is the Making Tax Digital (MTD) project. The timetable for introducing quarterly reporting under MTD has been rewritten. VAT registered businesses will be required to use accounting software to pump their VAT figures directly into HMRC’s computer, on a quarterly basis, from April 2019. Other businesses will commence MTD quarterly reporting from April 2020 or from a later date, once it can be shown that the MTD processes work smoothly.

The MTD project has not been canned; it continues with the more sensible approach of getting it right for larger businesses, before smaller businesses are expected to go digital for tax reporting.